#Logmein pro files update#

#Logmein pro files Patch#

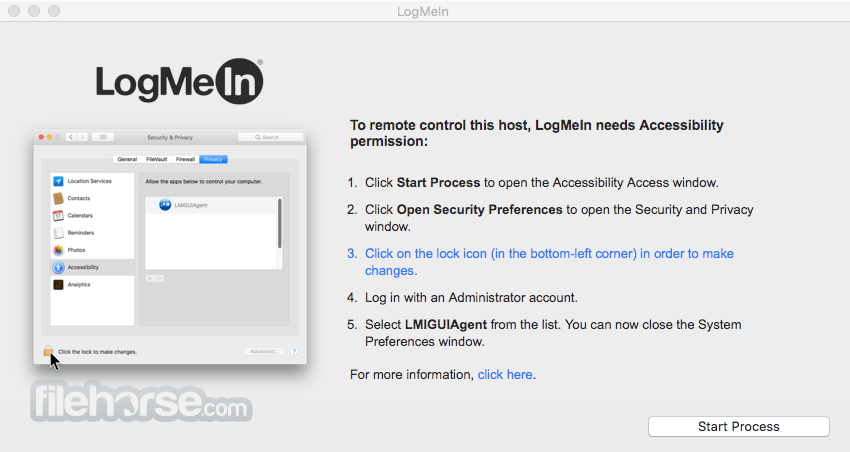

Patch Management with LogMeIn Pro Remote Desktop Software

#Logmein pro files android#

You can connect to any Windows or Mac device from your desktop, iOS, Android or even the browser. LogMeIn Pro further helps in sharing content across devices and collaborate is a hassle-free manner.

Arranging virtual meetings, delivering hybrid learning or organizing video conferences, all is easy with LogMeIn Pro. It provides a single unified platform to help teams collaborate with each other over text, chat, phone or videos. The remote access tool has been designed to ensure higher productivity. LogMeIn Pro is a remote desktop software specifically meant to help employers manage their staff and team remotely. LogMeIn Pro Software Pricing, Features & Reviews What is LogMeIn Pro? Buy Now & Pay Later, Check offer on payment page.Please be aware that if the wrong GST details are given when placing an order, the order will be automatically canceled. The delivery and billing addresses must match additionally, the GST authority will not grant input tax credits if the delivery address and GSTIN on the GST invoice are from different states. Please be aware that the provisions of the GST Act and rules must be followed in order to claim an input tax credit. Please choose the address that is listed as the registered place of business according to the GST authority's data in order to efficiently claim an input tax credit. Please be aware that is not in any way responsible for the GST Invoice or any associated input tax credit. and the Seller are not responsible for any failure on the part of the user, including issues related to information the user has provided. Users should make sure the information they enter is accurate.Īny request for a correction to the GST Invoice will not be entertained by or the Seller. Please be aware that the GST invoice must include the user's GSTIN and the name of the business entity that the user has specified. if an exchange offer is made concurrently with the purchase of the goods if the items come with Value Added Services such as Complete Mobile Protection or Assured Buyback. The following goods and services will not be eligible for GST Invoice: Only specific items sold by participating sellers and bearing the callout "GST Invoice Available" on the Platform's product detail page will be qualified for GST Invoice. Please be aware that not every product qualifies for a GST Invoice.

The User's specified Entity Name for the User's Registered Business The GSTIN submitted by the User in connection with the registered business of the User. The user will be sent a Tax Invoice ("GST invoice") for the purchase of all such products, which will, among other things, have the following information printed on it: Users are forbidden from using any of the products they buy through the Platform for business, advertising, resale, or further distribution. However, all purchases made on the Platform must be for personal use. Users who have registered businesses can buy products from merchants on the platform that meet their needs.

0 kommentar(er)

0 kommentar(er)